The National Intelligence Council has released a new report, Mapping the Global Future: Report of the National Intelligence Council’s 2020 Project, that leads with this doozy:

China will overtake Russia and others as the second largest defense spender after the United States over the next two decades and will be, by any measure, a first-rate military power.

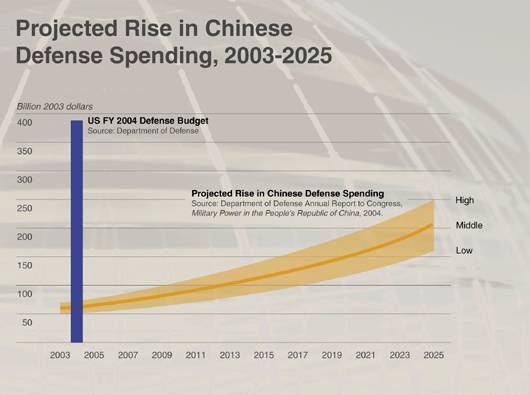

The NIC then provides a chart, which suggests Chinese defense expenditures in 2020 will be between $125-225 billion:

There is so much wrong with this estimate, I don’t know where to start.

1. The economic growth estimate provided by Goldman Sachs assumes a more than $ 7 trillion Chinese economy—that would make the Chinese economy more than 43% of the size of the US economy. Goldman Sachs is using a purchasing power parity estimate; yet, “for geo-political or geo-economic purposes, the market exchange rate is far more relevant,” warns Richard N. Cooper, a former NIC chairman. Using the market exchange rate, Cooper concludes “at best [the Chinese economy] will barely reach one quarter the US GDP by 2020.”

2. The CIA is using a twenty-five year old PPP estimate for defense goods. Yes, you read that correctly: when the CIA created its estimate, “Footloose” was topping the pop-charts. Here is how the State Department describes the intelligence community’s estimate:

Data for China are based on US Government estimates of the yuan costs of Chinese forces, weapons, programs, and activities.7 Costs in yuan are here converted to dollars using the same estimated conversion rate as used for GNP (see below). Due to the exceptional difficulties in both estimating yuan costs and converting them to dollars, comparisons of Chinese military spending with other data should be treated as having a wide margin of error.

7. Edward P. Parris, Chinese Estimated Expenditures, 1967-83. (Defense Intelligence Agency), November 1984.

Yet, the “wide margin of error” is not depicted in the chart nor is any allowance made for changes in the cost of defense goods.

I have long argued that one should dispense entirely with PPP adjustments when measuring defense spending. A much better estimate of Chinese defense spending in 2020 might look something like this:

- Using Dr. Cooper’s estimate of the Chinese economy in 2020, China would be lucky to reach Hu Jintao’s recently announced goal of a $4 trillion economy.

- On-budget defense spending in 2003 was approximately 1.6% of GDP. Chinese state expenditures, as a percent of GDP, are relatively low; China will probably continue to spend 1.5-2.0% of GDP on defense.

- Including “off budget’ defense expenditures, Chinese defense spending may be as high as 1.7-1.8 times the official defense budgdet (or 2.6-3.6% of GDP).

At this level of effort and economic growth, Chinese defense spending in 2020 would be between $60-80 billion (and may be as high as $100-150 billion if “off budget” expenditures continue to comprise a significant component of defense spending). $100-150 billion is about one-quarter of current U.S. defense spending and just a fraction of the $570 billion that I expect the United States to be spending in 2020 (assuming expenditures continue to account for about 3.5% of GDP).

Of course, Chinese economic growth might be considerably lower than these estimates. I conclude that, absent a dramatic change in China’s level of investment in defense goods, even the lowest NIC estimate is outside the plausible range of future Chinese defense expenditures.

Did you ever consider that if China’s economy reaches $4 trillion it is measured in todays dollars.

What if China’s currency appreciates by say %100 or more to the $US much like what happend to Japanese yen That would make China’s economy >$8 trillion.

Yes, I did consider the appropriate exhange rate. You obviously didn’t read the supporting documentation.

Here is the relevant paragraph from Cooper arguing for a neutral assumption on the exhange rate:

What is your evidence for assuming a 100 percent appreciation?

China’s GDP PPP at the end of 2005 was around $8 trillion, that’s about 65% of the US economy’s GDP of $12.3 trillion PPP. Keep in mind that the Chinese army is not going to buy American weapons, so the exchange rate GDP does not portray the real picture. Also, the Chinese army needs to spend much less US $, in order to match our Army capabilities – as the Russian and domestically produced weapons cost less than the American, and the Chinese soldier gets much much less than his American counterpart. And their economy will more than double in 10 years, at the current growth of 10%